Card-not-present (CNP) transaction fraud has become a growing threat in today’s digital payment ecosystem. Unlike traditional card-present transactions, CNP fraud occurs when neither the cardholder nor the physical credit card is present during a transaction, making it a hotspot for cybercriminals. The financial impact of CNP fraud is substantial, with losses rising steadily worldwide. To tackle this escalating challenge, biometric authentication has emerged as an advanced, reliable solution to curb fraud and protect consumers and businesses alike.

Understanding Card-Not-Present Transaction Fraud

A card-not-present transaction happens when a payment is made without the physical card being swiped or dipped. Common examples include online shopping, phone orders, invoicing, and recurring payments. These transactions rely solely on the customer providing card details such as the card number, CVV, and billing address.

However, this convenience comes with risks. Cybercriminals exploit several schemes to commit CNP fraud, including:

- Phishing: Fraudsters impersonate legitimate companies to steal user credentials.

- Hacking: Direct attacks on systems containing financial data, leading to stolen card information.

- Skimming: Stealing card data by placing skimming devices on card readers.

- Synthetic Identities: Creating fake identities using stolen data.

- Account Takeovers: Unauthorized access to existing accounts.

Statistics from 2023 to 2025 reflect a marked increase in CNP fraud incidents, underscoring the urgent need for stronger defenses.

Challenges of Traditional Fraud Prevention Methods

While the adoption of EMV chip technology has significantly reduced card-present fraud, it has limited impact on CNP fraud because the physical card is not involved. Merchants face considerable risks through chargebacks and fraud liability in CNP scenarios, often absorbing the costs of fraudulent transactions.

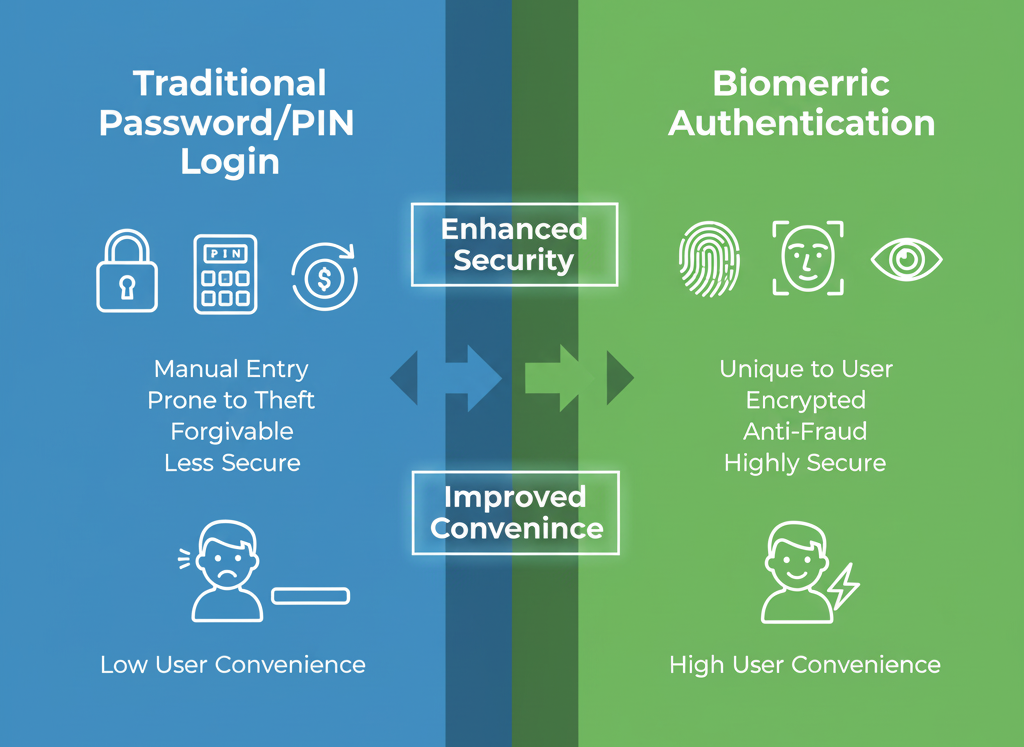

The absence of the cardholder and physical card makes it difficult to verify identity convincingly, creating gaps that fraudsters exploit. Traditional methods like passwords and CVV codes are increasingly insufficient to counter sophisticated fraud techniques.

Related Read: The Rise of Biometrics in the Cloud: Transforming Enterprise Security

Biometric Authentication as a Solution

Biometric authentication offers a powerful alternative by using unique physical or behavioral traits such as:

- Facial recognition,

- Voice authentication,

- Fingerprint scanning.

These modalities provide secure identity proofing, eliminating the need for passwords or PINs that can be stolen or guessed. Biometric authentication enhances customer experience by enabling seamless yet robust verification during payment transactions.

Integration of biometrics into payment workflows allows real-time blocking of unauthorized transactions, ensuring the cardholder’s identity is verified beyond doubt, thus drastically reducing fraud risk.

Case Studies and Industry Examples

Several businesses have successfully lowered their CNP fraud rates by adopting biometric solutions. Platforms like FortressID provide a unified approach combining global ID verification with biometric multifactor authentication, enabling continuous Know Your Customer (KYC) processes from onboarding to payment.

Comparative analyses reveal significant reductions in fraud and chargebacks post-implementation of biometric systems, demonstrating their effectiveness and ROI potential.

Implementation Considerations for Businesses

Businesses contemplating biometric integration should consider:

- The technical infrastructure needed to incorporate biometric authentication into existing payment systems.

- Compliance with data privacy regulations such as GDPR, ensuring biometric data is securely handled.

- Optimal customer experience strategies to encourage biometric usage without friction.

Adopting best practices during deployment ensures both security and convenience, fostering customer trust and loyalty..

Conclusion

The threat of card-not-present transaction fraud continues to rise, exposing weaknesses in traditional payment security methods. Biometrics represent the gold standard for secure, efficient, and user-friendly authentication in the digital era.

Businesses must embrace biometric authentication to protect customers, reduce financial losses, and maintain trust in their payment systems. The time to act is now—implementing biometric solutions is crucial to stay ahead of fraudsters and safeguard the future of commerce.